How to drive sales with purchase feedback

How to apply the ask, listen, and act framework to gain rapid insight into the purchasing funnel and improve sales.

Today’s shoppers demand frictionless buying journeys, whether in-store or online. Yet for many businesses, the path to online conversion remains a mystery. This is particularly true at the end of the customer journey, at the purchase stage.

You could say that the purchase stage is a black hole to most customer experience (CX) pros: 50% say they lack insights at this stage of the customer journey, according to our own research.

With revenue on the line, seamless online purchasing drives results—shoppers are less likely to abandon their carts when checkout is effortless. To boost sales, CX pros must plug real-time customer feedback into the purchase funnel. These insights allow teams to swiftly diagnose pain points, smooth friction, and optimize the most essential touchpoints fueling growth.

This guide outlines a proven ask, listen, act framework for gathering in-the-moment purchasing feedback across the customer journey. With these insights, retailers can:

- Pinpoint breakdowns in the buying process

- Understand decision drivers and barriers

- Improve self-service purchasing journeys

- Boost convenience, trust, and conversion

Giving sales and CX teams the insights they need on the purchase stage is the best way to keep customers moving efficiently from consideration to transaction. By creating feedback loops around the buying experience, you can continually optimize, innovate, and exceed evolving customer expectations.

Ask: Collect feedback

Picture this: You’re shopping for a new pair of running shoes online. You pull up the website of your favorite sporting goods store and browse their selection. You’re quickly overwhelmed by the number of choices, so you click on the first pair to read more about the product description. What does “pronation” mean? Do you really need “ultra-cloud soft support”? This is getting tricky, you contemplate heading to the nearest department store.

But you don’t have enough time, so you continue your search, finally landing on a pair. You go back to your cart and now must choose the option on how to receive your shoes: shipped, in-person, curbside? You weigh out the time and cost estimates for each and decide on curbside pick-up. Okay, looks like you can’t use your AMEX card here. Time to go grab another card. You’ve checked out and received email confirmation that they’ll be shipped to the nearest store in about a week. Easy? Not really, but you’ve made it through.

Considering this process from the retailer’s perspective, they likely only see a successful purchase. They don’t know how many questions the customer had while browsing. They don’t see the bugs that create frustration for the shopper.

That’s why the “ask” stage—that is, collecting feedback—is so important. Asking customers about their experience provides the opportunity to dig deep into each step and see the experience through their eyes. Without asking for feedback, you can easily miss the details.

Feedback illuminates the not-so-obvious issues of your customer’s experience. By asking for feedback at specific moments, like after a customer has completed a purchase, you can identify what the customer is feeling and thinking at that point in the customer journey–insight they may not share with you in the future.

Soliciting feedback at every stage of the purchasing journey is the only way to understand their expectations, frustrations, and speed bumps in real-time.

Let’s break down the steps to the ask stage.

1. The purchasing funnel

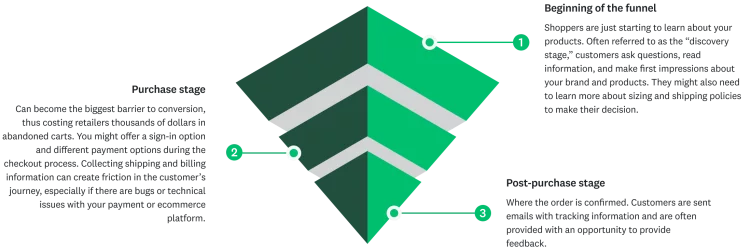

The purchasing process is referred to as a funnel because the number of customers who make it into each stage is reduced, or funneled, as browsers abandon their carts or never make it to checkout. Improving conversion rates enlarges the funnel so that more customers continue their journey and eventually convert.

The beginning of the funnel is where shoppers are just starting to learn about your products. Often referred to as the “discovery stage,” customers ask questions, read information, and make first impressions about your brand and products. They might also need to learn more about sizing and shipping policies to make their decision.

The purchase stage can become the biggest barrier to conversion, thus costing retailers thousands of dollars in abandoned carts. Online retailers might offer a sign-in option and different payment options during the checkout process. While this may be beneficial for the retailer, collecting shipping and billing information can create friction in the customer’s journey, especially if there are bugs or technical issues with your payment or ecommerce platform.

Finally, the post-purchase stage is where the order is confirmed. Online customers are sent emails with tracking information and are often provided with an opportunity to provide feedback.

2. How to collect feedback in the purchasing funnel

Most customers are generous with their feedback when given a chance. Just look at social media, for example, or the many online review sites where customers express their impressions, and report experiences and product results. Consumers are more actively reviewing products and services (and reviewing those reviews) than ever before.

In fact, when buying something for the first time, 74% of consumers say that reading reviews posted online by others who have purchased an item is important.

For companies looking to improve CX, real-time on-site or in-app feedback through surveys are different methods of asking customers to share their opinion. Each approach works best in certain situations.

Surveys for technical issues or bug reporting

If a customer runs into a problem while they’re checking out online, they aren’t likely to stop their purchase and contact customer support. Instead, they’ll probably just attempt to finish their purchase (or leave), and you’ll never be any the wiser.

Instead of letting technical disruptions go unchanged and frustrating customers, treat your customers as your most valued quality assurance testers, empowering them to report bugs in real-time.

Embed simple, non-intrusive feedback forms at multiple touchpoints across your site and apps. Make it effortless for customers to document glitches, friction points, or missing information right in the moment. Actively invite them to collaborate with your product team to squash bugs and smooth rough edges.

By quickly fixing technical issues, you can prevent them from impacting your conversion rate. Every solved problem saves your company from losing money from frustrated customers.

There are other reasons for capturing targeted and specific feedback with surveys— they allow you to segment and drill down on the exact questions you want to be answered. Let’s go over that next.

The benefits of on-site or in-app surveys

Every business has different questions they need to answer. Active surveys allow you to ask a precise set of users the right questions at specific points in the customer journey. And because they’re targeted, you can be more selective about the questions you ask, which keeps surveys shorter and customers more likely to want to engage with them.

Targeted surveys

The more specific you can be with your surveying, the more sophisticated your Voice of Customer (VoC) strategy can become.

Below are some examples:

- A company trying to increase sales of a new men’s accessory line could ask male browsers, “How would you describe your style?” to dig further into their audience’s interests.

- A company could ask customers in a particular region about their shipping or payment preferences to better serve their global customers.

3. What to measure

While qualitative in-the-moment feedback can provide a wealth of insight into how your users feel, quantitative measurements are also important. These metrics provide context around your customer’s feedback and can help you track progress toward key goals.

Goal Completion Rate (GCR): GCR measures whether a customer could accomplish the objective during their visit to your store. GCR is a KPI for monitoring online sales efforts. As customers move through the purchasing funnel, the more customers who complete their goal, the better your company will fare—reporting on the overall percentage of successful customers keeps the company’s focus right where it should be: on the customer.

It can either be measured within your website analytics program as a conversion metric (i.e. customer visited the online store and purchased) or used as a feedback metric.

When using GCR as a completion metric, use an exit survey to ask your customers if they accomplished their goal today. In some cases, customers are not ready to purchase yet—their goal might be to research available options. If customers did not accomplish their goal, request their contact information so you can follow up with them to assist further.

Whether measured as a conversion rate or as a feedback metric, GCR is reported as a percentage over a certain period (i.e. 25% GCR in the last week would mean that one out of every four users accomplished their goal).

Customer Effort Score: It’s generally accepted that making it easier to purchase from your online store results in more conversions. Customer Effort Score (CES) is a common metric used to measure how easy your customers find it to do business with you.

In the 2023 report on the state of CX, a vast majority of respondents said that the website's user-friendliness mattered in deciding whether to purchase. Most consumers (82%) have abandoned an online purchase due to a negative experience, such as encountering hidden fees or facing difficulties with website navigation.

Using in-the-moment feedback, ask customers how strongly they agree with the following statement: “Company made it easy to do ‘X,’” where ‘X’ may have several different goals, including purchasing, donating, getting help, etc.

Customers respond on a scale from 1-7, where 1 is “strongly disagree,” and 7 is “strongly agree.” To report CES, look at the average of the scores (aim for a score above 5) and the distribution. Interactions that result in a low score should be analyzed to see what friction customers have experienced.

Net Promoter Score®: The Net Promoter Score (NPS) is a metric specifically designed to accurately predict how likely a customer is to be loyal in the future. Rather than measuring individual interactions, NPS should be used holistically to understand how customers perceive their entire experience. Because of this, NPS is collected at the end of the purchasing funnel, after the product has been delivered.

To measure NPS, customers are asked, “How likely are you to recommend ‘X’ to a friend or family member?” Responses are collected on a scale of 1 (not very likely) to 10 (very likely). Customers who respond with a 6 or lower are considered detractors who are very likely to spread negative feedback about your product and likely won’t repurchase in the future without intervention. Customers who respond with a 9 or higher are Promoters, who can become brand advocates and are much more likely to purchase again in the future.

To calculate your NPS, subtract the percentage of customers who identified as detractors from the percent of customers who responded as promoters to receive a score between -100 and +100.

4. Best practices for measurement

When implementing surveys to collect CX metrics, there are several best practices to follow. These will keep your data collection accurate and improve the rates of responses.

Keep it short: Not only do most customers tend not to complete longer surveys, but the customers that do make it through to the end will also spend dramatically less time answering each question. Perhaps counterintuitively, it’s vital to keep surveys short to receive more thoughtful responses. Aim for fewer than three questions to have the best chance of good response rates.

In the moment: If there is a significant delay between the customer’s experience and your survey, their memory will fade, and you won’t receive detailed responses. Even worse, if customers aren’t asked for in-the-moment feedback, they would need to look for contact information to share their opinion.

Very few customers will put forth the effort to share their feedback when it isn’t easy.

Listen: Understand your customers’ needs

The second step in using digital feedback to improve online sales is to listen to the information and feedback you collected in the ask step. Without diving deep and understanding the “why” behind customer feedback, you might as well not even ask customers for their thoughts.

Listening and analyzing feedback does two things; first, it helps to clarify what customers are looking for and why. Secondly, it enables you to prioritize which actions you take.

Knowing how many customers are asking for what and how strongly they feel about their feedback can help identify which improvements will impact your sales. For example, if only a few customers ask to pay with AMEX, but they are your highest-paying customers and consistently rate your company poorly on surveys, it might be worth adding AMEX to your checkout process.

The success of your online sales depends on how many customers successfully follow through with their purchase on your website or app. Yet, many brands struggle with customers browsing, adding items to their cart, and exiting before taking further action. Improving shopping cart abandonment rates is critical to improving online sales.

The term shopping cart abandonment refers to when a prospective customer starts the checkout process for an online order but drops out before completing the purchase. In other words, when an item in an online shopping cart never makes it through the transaction, it’s considered to be “abandoned” by the shopper.

With feedback analysis on why customers are exiting digital channels, you can prioritize the changes to make based on what will impact the largest number of customers.

Next, we’ll discuss how to report the most critical UX metrics and how to combine these metrics with customer qualitative insight.

1. Combine metrics with qualitative feedback

Your anchor question is only part of the equation. While it’s useful to know that a customer did not achieve their goal or that their NPS response is a 5, that doesn’t tell you the why. And it certainly doesn’t tell you what you need to do to help them achieve the goal or become a promoter on their next experience.

Follow-up questions give visitors an opportunity to explain their answers. For example, consider a goal completion survey. The customer states that they have not achieved their goal. While that’s useful to know, adding two follow-up questions can help you better understand what’s really happening. A drop-down question might ask the customer to choose their goal from a list of options (i.e. make a purchase, research product options, get help). A second free-form question might give them space to write, in their own words, what prevented them from achieving their goal.

Linking scores like CES, NPS, and GCR with open questions helps you understand the why behind what customers tell you. Only when you’re equipped with this information can you start to act on customer feedback.

2. Report on the purchase funnel

Visual aids can be useful for displaying data. Many tools can help show the impact of your CX efforts in graphs, charts, and trendlines. These visual representations of your customers’ feedback are more impactful and persuasive than unprocessed data.

When reporting data, consider your audience. Whether it’s the C-Suite or your fellow colleagues, using tools that help illuminate what’s truly important will help you make your point and take action.

Benchmarking is another method of understanding what your data is telling you. With benchmarks, you can gauge how your product or service performs within your industry, giving you a clear understanding of where you fit in the bigger picture. Comparing your performance against the market can also help you set and achieve realistic goals. Within the SurveyMonkey platform, you can benchmark your feedback data against other businesses on NPS results.

Word clouds display the most commonly used words and phrases captured by your user feedback surveys. Using text analysis to comb through comments is a great way to understand what your users are talking about.

For example, if the most frequently used word in your word cloud is “shipping,” that’s a good place to start digging. From there, you could look at what customers say about the shipping policies and identify opportunities to improve verbiage or shipping options to boost conversion rates.

3. Use Integrations to provide context

Many businesses collect data through many different systems. You might be tracking your user’s website journey using Google Analytics and their shopping cart habits through an ecommerce platform. These data points can provide helpful information to enhance your understanding of customer feedback.

By connecting with other platforms, integrations pull in additional data to give you a full picture of what your customers did when they left feedback.

Many brands use Salesforce as a single source of truth for all customer data. We’ll dive deeper into integrating your customer feedback with Salesforce to improve online sales in the act chapter.

Combining quantitative metrics with qualitative insights gives you a holistic view of the customer experience. This sets you up to dive deeper into customer needs and understand exactly where to make changes across your digital channels. Once you’ve analyzed your digital feedback, it’s time to take action.

Act: Turn feedback into sales

You’ve collected customer feedback and analyzed it to make sense of it. Now is the time to turn that valuable feedback into action. Taking action is what synthesizes all of the digital feedback and surveys into higher conversion rates, increased revenue, and happier customers.

Taking action is usually a cross-functional process. It requires coordination and buy-in from several different teams. Additionally, with all metrics, it’s essential to close both the inner and outer feedback loop.

The inner feedback loop involves filtering feedback directly to the person who needs to read it. For GCR surveys, following up with customers who couldn’t complete their goal can recover a lost sale.

The outer feedback loop looks to find bigger trends and share that information across the company. For example, if multiple customers find it difficult to decide which size of sofa cover to order, it might make sense to create a new size chart or offer free exchanges for sizes.

In this section, we’ll walk through how you can mobilize your organization to act on digital feedback, respond to individual customers, and take more holistic action to drive online sales through a better experience.

1. Understand your goals and key stakeholders

The first step to taking action is to be purposeful about what you want to achieve. Start by identifying the metric or issue that you want to target. For example, through a GCR survey, you’ve identified a pricing issue causing customers to abandon their shopping carts partway through the purchasing journey.

Your goal is to reduce the shopping cart abandonment rate by 5% by making a pricing change. You’ll measure the effectiveness of your action by looking at GCR survey responses and shopping cart abandonment rates.

Secondly, because pricing changes impact many stakeholders within the organization, you’ll want to identify which departments should be involved. At the least, you’ll want to talk to:

- Sales, to determine the best strategy for overcoming pricing objections.

- Finance, to determine how a pricing change may impact the business’ finances.

- Marketing, to understand how the website will need to be changed.

- Engineering and Product, to uncover if changes are needed in the checkout process.

- Support, to update any documentation and alert them of potential customer inquiries.

Only when you understand your goals and have looped in every stakeholder should you proceed with making the change. With clear planning, you’ll be the most empowered to make the necessary changes and track the impact on your online sales.

2. Establish an internal feedback workflow

To organize and disseminate feedback that requires immediate action as quickly as possible, create a workflow for case management.

By prioritizing, setting a status, and assigning items to the right team or colleague, you’re empowered to create an efficient process of handling feedback.

- Prioritizing: Save time by triaging incoming feedback as “business-critical” or “non-critical.”

- Set a status: Keep everyone on the same page and work better using case statuses. Report progress and mark items as resolved when an action has been taken.

- Assign items: Get the feedback in the hands of the right person, quickly. Assign incoming feedback items and issues to the right team or person to ensure they are dealt with efficiently.

3. Close the loop with Salesforce

Connecting a digital feedback program with Salesforce helps create a complete CX program. You’ll be able to pull more context into your surveys and push feedback into Salesforce to take intelligent action that drives business results.

To close the loop with Salesforce:

- Start by defining your goals. You may be tracking GCR or NPS already. Improving these metrics is a great goal to start.

- Integrate your feedback platform with Salesforce. This connects your CX data from surveys with your CRM data on Salesforce. Ideally, this connection goes both ways so you can pull personalized data from your CRM into your surveys, and tie results into the specific customer record on Salesforce.

- Tailor your survey experience for each customer. Because you know who your customers are, and if they’ve purchased previously, you can ask them the right questions. Not only does this increase survey engagement, but it also gets you more valuable data to fill in the bigger picture.

- Automate your surveys. Using Salesforce, you can distribute your surveys with a controlled cadence so that customers don’t become fatigued and stop responding. Choose the channels you want to use, and time your surveys with your customers’ actions.

- Analyze and take action. Using dashboards and other visual reporting tools, you can get a quick overview of customer feedback. Determine your goals and take action to improve the customer’s experience and boost your online sales.

In conclusion

While both shopping channels and brick-and-mortar stores continue to meet consumers where they are, the convenience and personalization of online shopping has led to its dominant role in retail. Because of this, checkout optimization and customer feedback have become more pressing than ever.

The ask, listen, and act cycle helps businesses collect digital feedback that leads to actionable insights. Using these insights, you can improve sales.

Net Promoter® and NPS® are registered trademarks of Bain & Company, Inc., Satmetrix Systems, Inc., and Fred Reichheld.

Discover more resources

Customer satisfaction survey templates

Explore our customer satisfaction survey templates to rapidly collect data, identify pain points, and improve your customer experience.

3 ways to boost business growth by connecting SurveyMonkey and HubSpot

See how users are taking action on survey data to improve customer experience with the SurveyMonkey app for HubSpot.

How to use Forms to enhance your survey experience

How do surveys and forms differ? Learn how to combine form data with survey feedback for seamless events and experiences.

Beyond CX: How SurveyMonkey + Salesforce turn feedback into revenue

SurveyMonkey + Salesforce turn feedback into revenue

Ready to improve customer experience with feedback-based solutions?

Connect with one of our experts.